Financial Freedom: Frugal Living

If you're just tuning in, you can check out the first five posts about our journey to debt freedom. Check out these posts about our financial history how we acquired $34,000 worth of debt, the first step we took to get out of debt, what started to happen when we began Financial Peace University, and how we manage our budget.

We sincerely hope that sharing our journey is encouraging y'all and making you feel that you can have control over your finances. It's near impossible to describe the joy and relief that we feel since paying off all of our debt. We really believe that our income is a blessing from God and we need to strive to honor him with the decisions we make with our finances. For us, becoming debt free is the first step to doing just that.

But, let's be honest, we never could have paid off all of our debt had we not adopted some frugal habits. Thankfully, Neal and I have both always been pretty frugal by nature....but definitely myself more than Neal. And as I mentioned before, we saved in a lot of areas over the 2 and half years we've been married because, in a lot instances, we had to. When I wasn't working, it was impossible for us to eat out all the time, buy whatever we wanted AND run hard and fast toward being debt free.

So what exactly did we do to save? First of all, we got really honest with ourselves and each other about what our needs and wants are. This was difficult at first, but as long we kept our focus on the prize (being debt free) giving up those "wants" really seemed like no big thing.

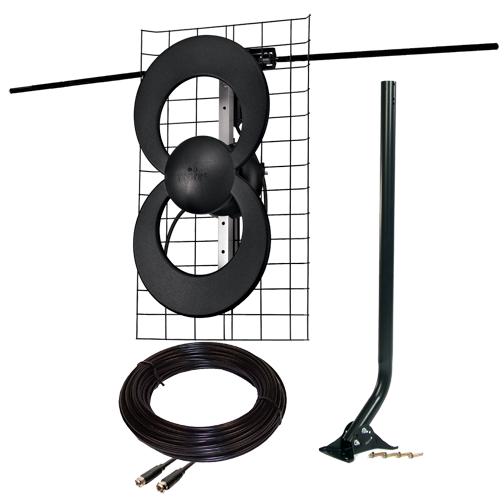

First to go? Cable. As long as we'd lived on our own, we'd each always had cable and it always seemed like a must-have. I don't remember the exact numbers, but I know we cut our bill about in half by cutting back from our cable/phone/internet package just to internet. We used our home phone approximately never so that was an easy choice to cut. And once Neal got over losing his hunting channels and I got over losing HGTV, we decided the cable definitely had to go too. (In Washington we bought a $40 indoor antenna...think rabbit ears...and because of the way our apartment was situated we got like 30 HD channels from that thing! Here in Virginia, we spent $100 on a long-range outdoor antenna which we mounted on the roof and we still get 30 HD channels with that.) While we're not huge TV-watchers (i.e. we don't really have any specific shows we keep up with) we do like to sit down and enjoy a TV show/movie together, so we do pay $8.99 a month to stream Netflix through our PS3. But we're about 2 years cable free, and we don't miss it a bit.

Another thing we did to save was to seriously cut back how often we eat out. I started to meal plan and cook all of our meals at home. We're blessed in that I really enjoy that whole process. I meal plan and plan a grocery list based solely on what we're going to eat that week. When I go grocery shopping, there's no "Oh yeah, that looks good!" or "Yeah, just throw that in the cart." Nope. As a matter of fact, Neal basically refuses to grocery shop with me because he can't stand how I only buy what's on my list. He wants to throw random stuff in the cart, and I just won't have it. Haha. This also forces us to eat a heck of a lot more healthy! Win-win! I'll warn you that because I only shop based on what we'll be eating, by the end of the week it looks like we're starving because our refrigerator, freezer, and cabinets are basically empty. But I count that as successful meal planning! I should also mention, it's not that we never eat out, we just don't eat out if we don't have the cash. Our "us" money is where our eating out funds come from in our budget.

Next up, date nights (or just time spent together). Neal and I are homebodies. We have a lot of at-home date nights. (This is easy for us as it's just the two of us in our household. Parents would definitely have to plan ahead for at-home date nights.) This has helped our budget tremendously. We get pretty creative with date nights. Board games. Puzzles. Video Games. Movies. Trivia. Projects around the house. We also like to make homemade pizza (way better than any take-out!) and homemade desserts for our date-nights instead of ordering in (but we do that sometimes too!). In the past we've avoided high costs by celebrating holidays like Valentine's Day at home too. (You can make a delicious surf and turf dinner and enjoy it by candelight for a fraction of the cost that it would be at a restaurant!) While we are homebodies, we do enjoy getting out and exploring too. We frequently just find a new place to visit (a park, trail, body of water, beach, landmark, historical site, anything) and we make an adventure out of it! We pack snacks or lunch and hit the road. It's so.much.fun. Going on adventures together is one of those things that has not only been good for our budget, but it's been GREAT for our marriage too. On our adventures, we frequently like to go geocaching. (If you haven't tried geocaching, DO IT! It's so fun! And it's FREE.)

Hand-me-downs. As I'm sitting here on our 15ish-year-old couch writing this, I'm looking around and thinking about our furniture and I can only think of one piece of furniture that we actually bought new. Literally everything else in our house, is a hand-me-down. And you know what? That's 100% okay. Our dining room table and chairs (which Neal bought at Big Lots when he was in college) is the only furniture we own that was purchased new. Neal did buy a brand new couch and loveseat set when he was in college, for a couple hundred bucks, and we had it in Washington, but it was junk (live and learn) and never would've survived the move back to Virginia, so we sold it before we left Washington. But seriously, our living room furniture was donated by my parents when they bought new furniture (this stuff has been around for at least 15 years and it's still in great shape!), our bedroom suit is my old one but was a hand-me-down my Mom bought from a co-worker when I was like 16, our guest room furniture is Neal's college furniture, our office furniture is my old stuff (probably 10 years old), and any other pieces of furniture we own were purchased at thrift stores or given to us by other family members. We frequently dream about what our dream home will look like; I make Neal walk the aisles of Home Goods with me, we pick up those books at Lowe's where you can design your kitchen, and we look up house plans and design our own floor plans. We have big plans. But we're in agreement that for right now, in this season of life, we're 100% okay with living with used items. When the time comes to buy or build a home, we'll invest in nicer, newer things, but in the meantime, we'll just save that money!

Clothes. I don't love to shop, but I love clothes. This is the biggest way I blow my money. I spend a pretty big chunk of my spending money on clothes (I'm getting better though!). Neal used to tease me about not being able to go into Target without buying a new piece of clothing. The thing is, he wasn't wrong. Neal could care less about clothes and fortunately for him, my Mom loves to buy him clothes (seriously, most of his bright plaid/striped shirts are from her). I frequently purge my closet and I've started using this in my favor. I discovered thredUP (this link leads you to a free $10 credit if you want to buy yourself something...and yes, I get $10 too) about a year ago and ever since, it's been my best friend! They send me a bag for free, I send them my clothes, and then they pay me for the clothes I sent them! And what they don't accept, they donate for me! Perfect. I can then buy gently-used and new clothes on their site or cash out my credit (I've never personally done this). I've always been extremely pleased with the clothes I've ordered from them.

Be honest! This one is so easy. It's so easy when people ask, "What do you want for your birthday?" or "What do you want for Christmas?" to just say, "Oh, I don't know!" thinking that you're being modest (which is not a bad thing!), but if we were being honest, I'm sure there's SOMETHING you want. Our families always buy us gifts. And we'd rather them get us something we desire rather than something we really hate. So when our family asks us what we want, we tell them! This year we even made wishlists on our favorite websites (I used Pinterest) and it was SO MUCH EASIER for people to buy us gifts! And remember, it's just that, a wishlist. It doesn't mean we expect to get what's on the list, but a wishlist helps give people an idea of something you may really enjoy instead of just guessing. (Seriously, several of our family members did this this year and it was so much more enjoyable to know we were actually getting people things they wanted!) It also helps our families not waste their money. And if we want something really expensive, we'll flat out tell family, "Get me a gift card to ______" or "Cash would really be great, I'm saving for _______".

These are the main ways we limit our spending, but we also cut costs by: limiting our subscriptions (gym, magazine, etc.), run errands all at one time to cut down on gas costs, research items before purchasing, buy books for free from sites like BookBub, only run appliances (washer, dryer, dishwasher) when they are full, and we do use coupons if we have them.

Neal and I would love to hear some tips from you all as well as I'm sure you have some awesome tips to increase savings. Next time we'll share all about what our big plans are now that we're 100% debt free!

We sincerely hope that sharing our journey is encouraging y'all and making you feel that you can have control over your finances. It's near impossible to describe the joy and relief that we feel since paying off all of our debt. We really believe that our income is a blessing from God and we need to strive to honor him with the decisions we make with our finances. For us, becoming debt free is the first step to doing just that.

But, let's be honest, we never could have paid off all of our debt had we not adopted some frugal habits. Thankfully, Neal and I have both always been pretty frugal by nature....but definitely myself more than Neal. And as I mentioned before, we saved in a lot of areas over the 2 and half years we've been married because, in a lot instances, we had to. When I wasn't working, it was impossible for us to eat out all the time, buy whatever we wanted AND run hard and fast toward being debt free.

So what exactly did we do to save? First of all, we got really honest with ourselves and each other about what our needs and wants are. This was difficult at first, but as long we kept our focus on the prize (being debt free) giving up those "wants" really seemed like no big thing.

|

| Image Link |

|

| Pinterest is my best friend when it comes to meal planning! |

|

| Image Link |

Hand-me-downs. As I'm sitting here on our 15ish-year-old couch writing this, I'm looking around and thinking about our furniture and I can only think of one piece of furniture that we actually bought new. Literally everything else in our house, is a hand-me-down. And you know what? That's 100% okay. Our dining room table and chairs (which Neal bought at Big Lots when he was in college) is the only furniture we own that was purchased new. Neal did buy a brand new couch and loveseat set when he was in college, for a couple hundred bucks, and we had it in Washington, but it was junk (live and learn) and never would've survived the move back to Virginia, so we sold it before we left Washington. But seriously, our living room furniture was donated by my parents when they bought new furniture (this stuff has been around for at least 15 years and it's still in great shape!), our bedroom suit is my old one but was a hand-me-down my Mom bought from a co-worker when I was like 16, our guest room furniture is Neal's college furniture, our office furniture is my old stuff (probably 10 years old), and any other pieces of furniture we own were purchased at thrift stores or given to us by other family members. We frequently dream about what our dream home will look like; I make Neal walk the aisles of Home Goods with me, we pick up those books at Lowe's where you can design your kitchen, and we look up house plans and design our own floor plans. We have big plans. But we're in agreement that for right now, in this season of life, we're 100% okay with living with used items. When the time comes to buy or build a home, we'll invest in nicer, newer things, but in the meantime, we'll just save that money!

Clothes. I don't love to shop, but I love clothes. This is the biggest way I blow my money. I spend a pretty big chunk of my spending money on clothes (I'm getting better though!). Neal used to tease me about not being able to go into Target without buying a new piece of clothing. The thing is, he wasn't wrong. Neal could care less about clothes and fortunately for him, my Mom loves to buy him clothes (seriously, most of his bright plaid/striped shirts are from her). I frequently purge my closet and I've started using this in my favor. I discovered thredUP (this link leads you to a free $10 credit if you want to buy yourself something...and yes, I get $10 too) about a year ago and ever since, it's been my best friend! They send me a bag for free, I send them my clothes, and then they pay me for the clothes I sent them! And what they don't accept, they donate for me! Perfect. I can then buy gently-used and new clothes on their site or cash out my credit (I've never personally done this). I've always been extremely pleased with the clothes I've ordered from them.

Be honest! This one is so easy. It's so easy when people ask, "What do you want for your birthday?" or "What do you want for Christmas?" to just say, "Oh, I don't know!" thinking that you're being modest (which is not a bad thing!), but if we were being honest, I'm sure there's SOMETHING you want. Our families always buy us gifts. And we'd rather them get us something we desire rather than something we really hate. So when our family asks us what we want, we tell them! This year we even made wishlists on our favorite websites (I used Pinterest) and it was SO MUCH EASIER for people to buy us gifts! And remember, it's just that, a wishlist. It doesn't mean we expect to get what's on the list, but a wishlist helps give people an idea of something you may really enjoy instead of just guessing. (Seriously, several of our family members did this this year and it was so much more enjoyable to know we were actually getting people things they wanted!) It also helps our families not waste their money. And if we want something really expensive, we'll flat out tell family, "Get me a gift card to ______" or "Cash would really be great, I'm saving for _______".

These are the main ways we limit our spending, but we also cut costs by: limiting our subscriptions (gym, magazine, etc.), run errands all at one time to cut down on gas costs, research items before purchasing, buy books for free from sites like BookBub, only run appliances (washer, dryer, dishwasher) when they are full, and we do use coupons if we have them.

Neal and I would love to hear some tips from you all as well as I'm sure you have some awesome tips to increase savings. Next time we'll share all about what our big plans are now that we're 100% debt free!

Comments

Post a Comment