Financial Freedom: Budgeting

If you're just tuning in, you can check out the first four posts about our journey to debt freedom. Check out these posts about our financial history how we acquired $34,000 worth of debt, the first step we took to get out of debt, and what started to happen when we began Financial Peace University.

Sorry to leave y'all so abruptly last time. There's so much to cover! So it was October 2014. We were paying $1000 a month on the only debt we had left and we were determined to pay it off within the next three months. From October to December 2014 we paid $1000 a month toward our auto loan. And I'm OVERJOYED and relieved to, once again, report that we paid off that final debt right on time. Just this past week, on January 6, I wrote the LAST check for our auto loan. Our lien-holder is working on submitting all the appropriate paperwork and the Certificate of Title will be sent to us shortly. WOOP WOOP!

From the time we started Financial Peace University, and chose to dump all of our debt for good, until we mailed in our last payment, it only took us 15 months to finish paying off our debt. In total, we paid on our debt for 3 years and 2 months. We paid my student loans off in 2 years and 2 months which means we paid them off 7 years and 10 months early. We paid our auto loan off in 2 years and 8 months which means we paid that off 3 years and 4 months early. So really, y'all, you can make it happen!

So...how did we do it? First of all, let me start off with tithing. Neal and I were both tithing intermittently prior to getting married. This pattern continued into our marriage. We were tithing intermittently but we were, for sure, not tithing 10% of our income. When we went through FPU, we prayed about it and both agreed that no matter what we were going to start tithing 10%. I don't find it coincidence at all that at the time our church had just begun a series on finances and was doing a 90-day challenge. The church challenged everyone to tithe 10% of whatever their income for 90 days; if after 90 days you felt it was just making you broke and saw nothing else come out of it, they offered to return people's money. We figured we had nothing to lose (although, who is really going to ask for their money back? Just sayin'). We began tithing 10% consistently at the beginning of October 2013. After applying for SO MANY jobs in the 6 months I was at home, I finally got a call for an interview at an agency I really wanted to work for. I interviewed and then began work the next week. Again, I don't find it to be a coincidence that as soon as we began to first give back to God, He blessed me with a job in my field. This is just an example of one of the many blessings we have experienced since tithing 10% above and beyond everything else. In sharing that, if you don't take anything else away from any of these jumbled thoughts, I'd encourage you to pray about tithing if you're not doing it already.

Now, more about our budget. Prior to going through FPU, I was already doing a budget and keeping track of all of our expenses. If you're not doing this. Start. We believe the only way to control how you spend your money is to know where your money is going. Like I'd mentioned before, we knew how much we were eating out, but to see the weekly or monthly total of restaurant costs, we were appalled and, I don't know about Neal, but I was kind of embarrassed.

FPU was just the encouragement Neal needed to get involved with our finances. I was ecstatic to make this into a team effort. FPU encourages you to have a "Budget Committee Meeting" (Sound familiar, Baptists? Haha) that lasts no more than 17 minutes and have both parties (especially the free spirit, aka Neal) change something on the budget. Our first meeting was comical. I had so much to say I was afraid we'd run over 17 minutes. Neal literally set a timer. He had just about had it and the dog was barking to go out. As soon as he got up let the dog out (he was so itching to be done with the meeting) the timer went off. I was disappointed and Neal was SO RELIEVED. That still gives us a good laugh. (I read this post to Neal before posting it as I do every time and we both laughed at this yet again. It shows our personalities so perfectly! Haha.)

However ridiculous our first meeting was, that was the first step to us doing this as a unit. We've come a long way since then, folks! I still create the budget, and then I run it by Neal, he contributes, makes changes as he sees fit, we discuss things if they need discussing, and then we call it done. (Just an FYI, we used Microsoft Excel to write and track our budget for years but just this year we're using Google Sheets. We like that we can access Google Sheets at any time and I can create under my account and share it with Neal so he can also access it anytime he wants.)

So...the content of our budget. I make a list of all the necessities each month. For example, those currently include: Rent, Gas (heat), Water, Trash, Electric, Insurance, Gas (vehicles), Groceries, and Medication. I write down how much they'll be that month, and if I'm not sure, I always overestimate. I do that part on paper. Next, I input everything into Google Sheets. I list our spending by week. I put our incomes, and then all expenses. In the expenses category our tithes are always the first thing we list. We plan for those first and foremost. It's much easier to first do on paper. I highly recommend using these budgeting sheets that Dave Ramsey offers. They're the most detailed and inclusive budgeting sheets I've yet to come across.

Depending on where we were at in our journey (two-incomes, one-income, three debts, one debt, etc.) determined how much of the "extra" stuff we added into the budget. From the get-go, Neal made it clear that he's okay with a budget, but he didn't want to feel like he couldn't ever buy anything. So, for us, we built in spending money each week. Neal gets a little bit more than I do and we're both 100% okay with that.

This would also be a good place to mention that we work primarily in cash. Not as in cash versus credit. As in, green, paper, cash. We really benefit from using the envelope system. We use our debit cards for buying gas for the vehicles and I pay our other bills either by check or online. But everything else gets paid in cash. I go to the bank each week and get our our allotted amount of money; this includes money for groceries, our spending money, and any extras (i.e. pet nail trim, gifts, vehicle repairs, etc.). I then place the money in my envelope (I keep labeled dividers in my wallet) and I give Neal his spending money for the week. For us it is easier to manage weekly amounts versus monthly but do whatever works for you. The premise of the envelope system is that you can't overspend. For example, if I go into Target with $50 cash, I can't buy groceries and those cute new $45 boots, I only have enough for groceries. We also roll over any money left over from week-to-week in each category.

Currently, our budget categories include: Tithe, Groceries, "Us" Money (i.e. for date nights or stuff we want to do together), Spending Money (each of us get a separate line in the budget), Gas for vehicles, Rent, Electric, Water, Trash, Gas (heat), Insurance (we pay our renter's insurance in full up front and pay our car insurance monthly), Medication, Cell Phones, Gym (Neal plans to end that when his year ends in March), Internet, and Netflix. These are our monthly expenses. Previously our debts were added in there too. We try to think ahead and plan for expenses ahead of time. For example, we're already discussing a summer vacation and agreed on a plan to save for it. Other expenses we plan for ahead of time are: clothes, doctor's appointments, vehicle repairs, gifts, magazine subscriptions, vehicle registrations, taxes, and vacations. We also plan in advance for things pertaining to our hobbies. Neal loves to hunt and I enjoy crafting. Neither of those are cheap hobbies. We always research a lot before making big purchases and those go into the budget. Small things we use our spending money to purchase and even if something costs $100, we encourage each other to just save up for it or ask for gift cards or money as gifts for our birthdays or Christmas to put towards whatever it may be that we want to buy.

We do all of this so that we stay in control of our money and our money doesn't control us. We've always been pretty frugal, but we've adopted some good habits to help us save over the course of this journey. Next time I'll share with y'all some of those habits so you can start putting them to use too! And no, it doesn't involve couponing.

Sorry to leave y'all so abruptly last time. There's so much to cover! So it was October 2014. We were paying $1000 a month on the only debt we had left and we were determined to pay it off within the next three months. From October to December 2014 we paid $1000 a month toward our auto loan. And I'm OVERJOYED and relieved to, once again, report that we paid off that final debt right on time. Just this past week, on January 6, I wrote the LAST check for our auto loan. Our lien-holder is working on submitting all the appropriate paperwork and the Certificate of Title will be sent to us shortly. WOOP WOOP!

From the time we started Financial Peace University, and chose to dump all of our debt for good, until we mailed in our last payment, it only took us 15 months to finish paying off our debt. In total, we paid on our debt for 3 years and 2 months. We paid my student loans off in 2 years and 2 months which means we paid them off 7 years and 10 months early. We paid our auto loan off in 2 years and 8 months which means we paid that off 3 years and 4 months early. So really, y'all, you can make it happen!

So...how did we do it? First of all, let me start off with tithing. Neal and I were both tithing intermittently prior to getting married. This pattern continued into our marriage. We were tithing intermittently but we were, for sure, not tithing 10% of our income. When we went through FPU, we prayed about it and both agreed that no matter what we were going to start tithing 10%. I don't find it coincidence at all that at the time our church had just begun a series on finances and was doing a 90-day challenge. The church challenged everyone to tithe 10% of whatever their income for 90 days; if after 90 days you felt it was just making you broke and saw nothing else come out of it, they offered to return people's money. We figured we had nothing to lose (although, who is really going to ask for their money back? Just sayin'). We began tithing 10% consistently at the beginning of October 2013. After applying for SO MANY jobs in the 6 months I was at home, I finally got a call for an interview at an agency I really wanted to work for. I interviewed and then began work the next week. Again, I don't find it to be a coincidence that as soon as we began to first give back to God, He blessed me with a job in my field. This is just an example of one of the many blessings we have experienced since tithing 10% above and beyond everything else. In sharing that, if you don't take anything else away from any of these jumbled thoughts, I'd encourage you to pray about tithing if you're not doing it already.

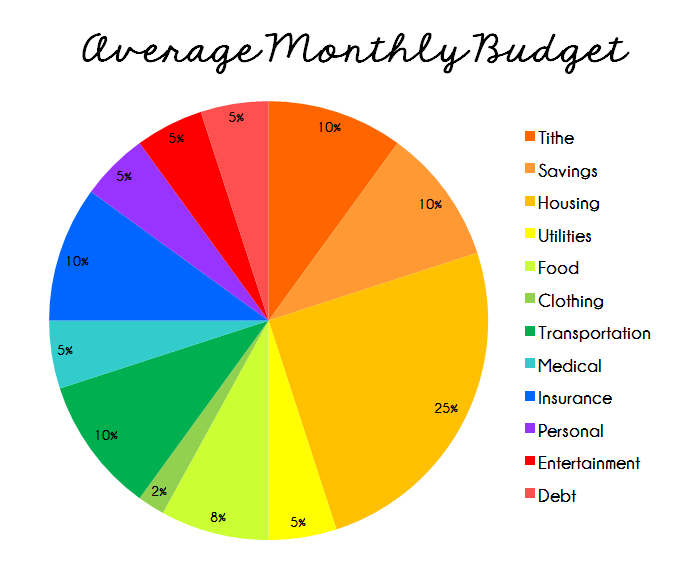

Averages are: Tithe: 10-15% | Saving: 10-15% | Housing:

25-35% | Utilities 5-10% | Food: 5-15% | Clothing: 2-7% |

Transportation: 10-15% | Medical: 5-10% | Insurance: 10-25% | Personal:

5-10% | Entertainment: 5-10% | Debts 5-10%

FPU was just the encouragement Neal needed to get involved with our finances. I was ecstatic to make this into a team effort. FPU encourages you to have a "Budget Committee Meeting" (Sound familiar, Baptists? Haha) that lasts no more than 17 minutes and have both parties (especially the free spirit, aka Neal) change something on the budget. Our first meeting was comical. I had so much to say I was afraid we'd run over 17 minutes. Neal literally set a timer. He had just about had it and the dog was barking to go out. As soon as he got up let the dog out (he was so itching to be done with the meeting) the timer went off. I was disappointed and Neal was SO RELIEVED. That still gives us a good laugh. (I read this post to Neal before posting it as I do every time and we both laughed at this yet again. It shows our personalities so perfectly! Haha.)

However ridiculous our first meeting was, that was the first step to us doing this as a unit. We've come a long way since then, folks! I still create the budget, and then I run it by Neal, he contributes, makes changes as he sees fit, we discuss things if they need discussing, and then we call it done. (Just an FYI, we used Microsoft Excel to write and track our budget for years but just this year we're using Google Sheets. We like that we can access Google Sheets at any time and I can create under my account and share it with Neal so he can also access it anytime he wants.)

So...the content of our budget. I make a list of all the necessities each month. For example, those currently include: Rent, Gas (heat), Water, Trash, Electric, Insurance, Gas (vehicles), Groceries, and Medication. I write down how much they'll be that month, and if I'm not sure, I always overestimate. I do that part on paper. Next, I input everything into Google Sheets. I list our spending by week. I put our incomes, and then all expenses. In the expenses category our tithes are always the first thing we list. We plan for those first and foremost. It's much easier to first do on paper. I highly recommend using these budgeting sheets that Dave Ramsey offers. They're the most detailed and inclusive budgeting sheets I've yet to come across.

Compared to the "average" budget (above) we fall right in

line. Tithe: 10.2% | Savings 18.9% | Housing: 22.6% | Utilities 9.1% |

Food 9.4% | Clothing: 0% | Transportation: 5.7% | Medical: .1% |

Insurance: 2% | Personal: .6% | Entertainment 8.9% | Debt 0%|

I should also note that all of our health insurance, life insurance, and retirement contributions come out before taxes.

I should also note that all of our health insurance, life insurance, and retirement contributions come out before taxes.

This would also be a good place to mention that we work primarily in cash. Not as in cash versus credit. As in, green, paper, cash. We really benefit from using the envelope system. We use our debit cards for buying gas for the vehicles and I pay our other bills either by check or online. But everything else gets paid in cash. I go to the bank each week and get our our allotted amount of money; this includes money for groceries, our spending money, and any extras (i.e. pet nail trim, gifts, vehicle repairs, etc.). I then place the money in my envelope (I keep labeled dividers in my wallet) and I give Neal his spending money for the week. For us it is easier to manage weekly amounts versus monthly but do whatever works for you. The premise of the envelope system is that you can't overspend. For example, if I go into Target with $50 cash, I can't buy groceries and those cute new $45 boots, I only have enough for groceries. We also roll over any money left over from week-to-week in each category.

Currently, our budget categories include: Tithe, Groceries, "Us" Money (i.e. for date nights or stuff we want to do together), Spending Money (each of us get a separate line in the budget), Gas for vehicles, Rent, Electric, Water, Trash, Gas (heat), Insurance (we pay our renter's insurance in full up front and pay our car insurance monthly), Medication, Cell Phones, Gym (Neal plans to end that when his year ends in March), Internet, and Netflix. These are our monthly expenses. Previously our debts were added in there too. We try to think ahead and plan for expenses ahead of time. For example, we're already discussing a summer vacation and agreed on a plan to save for it. Other expenses we plan for ahead of time are: clothes, doctor's appointments, vehicle repairs, gifts, magazine subscriptions, vehicle registrations, taxes, and vacations. We also plan in advance for things pertaining to our hobbies. Neal loves to hunt and I enjoy crafting. Neither of those are cheap hobbies. We always research a lot before making big purchases and those go into the budget. Small things we use our spending money to purchase and even if something costs $100, we encourage each other to just save up for it or ask for gift cards or money as gifts for our birthdays or Christmas to put towards whatever it may be that we want to buy.

We do all of this so that we stay in control of our money and our money doesn't control us. We've always been pretty frugal, but we've adopted some good habits to help us save over the course of this journey. Next time I'll share with y'all some of those habits so you can start putting them to use too! And no, it doesn't involve couponing.

Comments

Post a Comment